Abc’s Construction Backlog Indicator and Contractor Confidence Index Rise in February

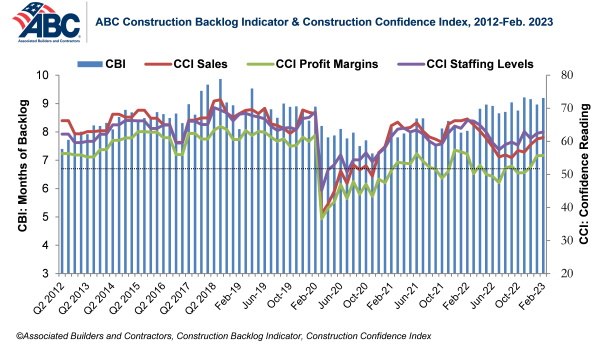

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

View the historic Construction Backlog Indicator and Construction Confidence Index data series.

Backlog rebounded in February and for the past four months has hovered around highs not seen since the start of the pandemic. The Southern region continues to post the highest backlog of any region and, as of February, has had at least 11 months of backlog in four of the previous five months.

ABC’s Construction Confidence Index reading for sales, profit margins and staffing levels increased in February. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“Despite a gloomy economic forecast and extraordinarily elevated borrowing costs, contractor backlog and confidence continue to rise,” said ABC Chief Economist Anirban Basu. “This mirrors the broader economy, which has thus far proved resilient in the face of rising interest rates. While economic strength, particularly regarding labor demand, is surprising, interest rate increases typically take 12 to 18 months to affect the broader economy, and the first interest rate increase occurred in March 2022.

“While backlog remains at a historically elevated level, borrowing costs will continue to rise during the next several months, and contractors continue to struggle in the face of skilled labor shortages,” said Basu. “If economic momentum fades this year, as a majority of forecasters continue to predict, then backlog and confidence may decline, especially for contractors working predominantly on privately financed projects.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.